Algorithmic trading has transformed the landscape of financial markets, allowing traders to execute complex strategies with precision and speed. As the market evolves, so do the techniques and blueprints that can enhance trading performance. In this article, we will explore advanced algorithmic trading strategies that maximize precision, minimize risks, and aim for consistent results.

Contents

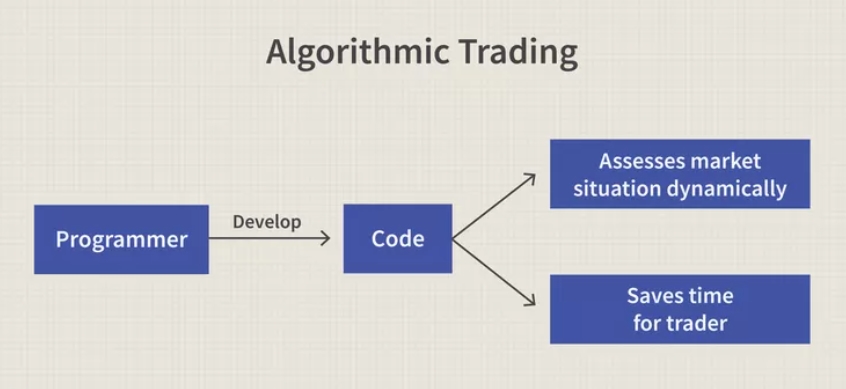

Understanding Algorithmic Trading

Algorithmic trading involves using computer algorithms to automate trading decisions based on predetermined criteria. These algorithms can analyze vast amounts of market data in real time, identifying patterns and trends that human traders might overlook. By leveraging technology, traders can execute strategies at a speed and frequency that would be impossible manually.

The key components of algorithmic trading include data analysis, signal generation, and trade execution. Traders create algorithms that analyze historical and real-time data to generate trading signals. These signals dictate when to buy or sell assets, allowing traders to capitalize on market opportunities quickly.

Advanced Strategies for Precision and Consistency

- Statistical Arbitrage: This strategy involves exploiting price discrepancies between correlated assets. By using statistical models, traders identify when an asset deviates from its expected price relationship with another. The algorithm simultaneously buys the undervalued asset and sells the overvalued one, aiming for profit when the prices converge.

- Machine Learning Models: As technology advances, machine learning has become a game-changer in algorithmic trading. By training algorithms on historical data, these models can identify complex patterns that may indicate future price movements. Techniques such as neural networks and reinforcement learning can adapt to changing market conditions, enhancing predictive accuracy.

- High-Frequency Trading (HFT): HFT leverages speed to execute trades within fractions of a second. While often criticized for its complexity and potential market impact, HFT can be profitable when implemented correctly. Traders utilize algorithms that analyze market data and execute trades based on micro price movements, capitalizing on minute fluctuations.

- Trend Following Strategies: These strategies rely on the idea that assets tend to move in persistent directions. Algorithms can identify trends and generate buy or sell signals based on momentum indicators. By entering trades in the direction of the trend, traders can achieve consistent returns while managing risk.

Minimizing Risks in Algorithmic Trading

Despite the advantages of algorithmic trading, risks remain. Here are some techniques to mitigate these risks:

- Backtesting: Before deploying an algorithm in the live market, thorough backtesting is essential. This process involves running the algorithm against historical data to evaluate its performance. Traders can identify potential weaknesses and refine strategies to enhance robustness.

- Diversification: Implementing a diversified portfolio can reduce the impact of poor performance in any single asset. Algorithms can be designed to trade multiple instruments simultaneously, spreading risk and capitalizing on various market opportunities.

- Risk Management Rules: Establishing strict risk management rules is crucial. This includes setting stop-loss orders, determining position sizes, and limiting overall exposure. Algorithms should incorporate these rules to ensure disciplined trading and protect against unforeseen market events.

- Regular Monitoring and Adjustment: Markets are dynamic, and algorithms must adapt to changing conditions. Regular monitoring allows traders to assess performance, make necessary adjustments, and ensure that strategies remain effective over time.

Achieving Consistent Results

The ultimate goal of any trading strategy is to achieve consistent results. To do this, traders must focus on the following principles:

- Continuous Learning: The financial markets are ever-evolving. Staying updated with the latest trends, technologies, and strategies is essential for long-term success. Continuous education helps traders refine their algorithms and enhance their trading acumen.

- Emotionless Trading: One of the significant advantages of algorithmic trading is the elimination of emotional decision-making. Traders should ensure that their algorithms are programmed to execute trades based on data and analysis rather than subjective feelings or market hype.

- Performance Evaluation: Regularly assessing the performance of trading strategies is vital. This includes analyzing metrics such as Sharpe ratio, drawdown, and win rate. By understanding the strengths and weaknesses of their algorithms, traders can make informed decisions about future adjustments.

- Building a Robust Infrastructure: A strong technical infrastructure supports algorithmic trading. This includes reliable data feeds, execution platforms, and risk management tools. Investing in quality technology ensures that algorithms perform optimally, minimizing the potential for downtime or errors.

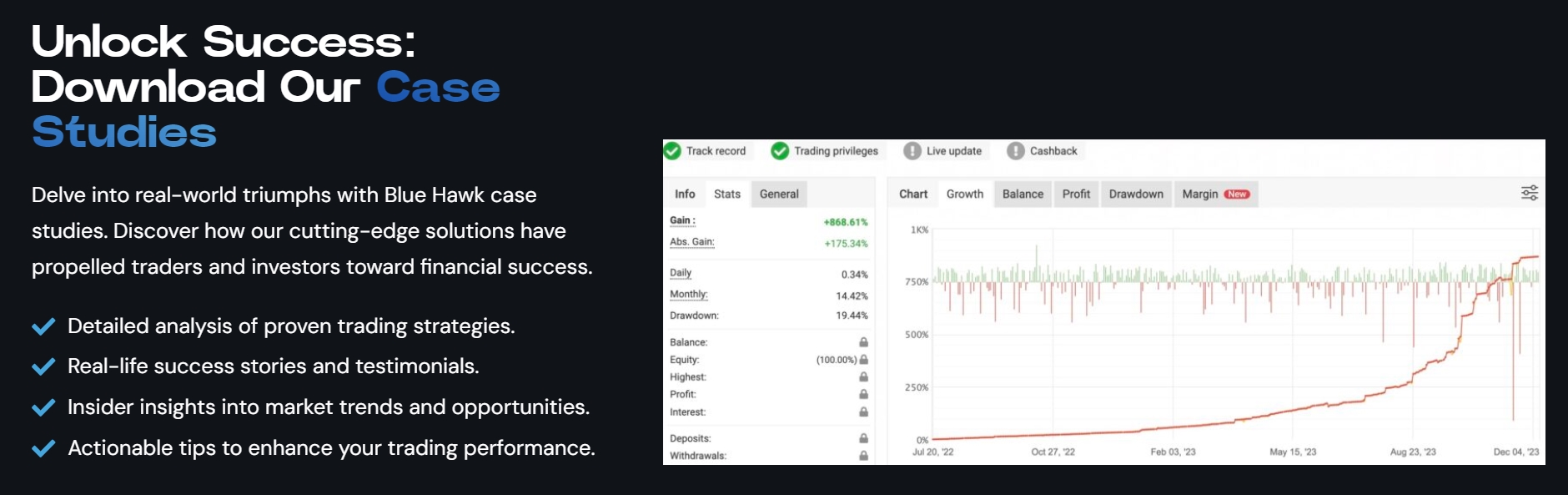

Unleashing the full power of algorithmic trading strategies requires a combination of advanced techniques, risk management, and consistent evaluation. By leveraging technology and adopting a disciplined approach, traders can navigate the complexities of the financial markets and achieve impressive results, much like Blue Hawk Automation, Dave Nelson, a seasoned Forex expert with over 14 years of experience. Whether you are a novice or an experienced trader, the world of algorithmic trading offers exciting opportunities to maximize precision, minimize risks, and achieve consistent success.